Schedule 5 Section 102 Appeals. Federal Legislation Portal Malaysia.

28 September 1967 BE IT ENACTED by the Seri Paduka Baginda Yang di.

. 109B2 of the Income Tax Act 1967. Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and reliable as a student text. Charge of petroleum income tax 4.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the following link. Manner in which chargeable income is to be ascertained P ART III ASCERTAINMENT OF CHARGEABLE. Interpretation P ART II IMPOSITION OF THE TAX 3.

Short title extent and commencement 2. Finance Act 2018 had introduced a new Section 140C to the Income Tax Act 1967 ITA to restrict the deductibility of interest expenses incurred by a person in respect of his business income in certain circumstances. The Inland Revenue Board of Malaysia IRBM is one of the main revenue collecting agencies of the Ministry of Finance.

Income tax rules and legislative notifications have been reproduced or summarised in an easy-to-read table format. With effect from YA 2004 foreign source income derived from sources. Or Income Tax Act 1967.

Khamis Mac 10 2016 INCOME TAX EXEMPTION A. LAWS OF MALAYSIA Act 543 PETROLEUM INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS P ART I PRELIMINARY Section 1. 28 September 1967 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan Rakyat in Parliament assembled and by the authority of the.

Example 2 Marco a Filipino is a seafarer. 1 Every appeal shall be heard by three Special Commissioners at least one of whom shall be a person with judicial or other legal experience within the meaning of subsection 983. In addition the Employees Provident Fund contribution rates and.

8 Laws of Malaysia ACT 543 9Petroleum Income Tax LAWS OF MALAYSIA Act 543 PETROLEUM INCOME TAX ACT 1967 An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith. Currently the ITA 1967 contains 13 Parts with 13 Schedules and 156 Sections. This volume contains the full text of the Income Tax Act 1967.

2 If a Chairman. The ITA 1967 was first enacted in 1967 and frequently amended to accommodate the rapid development in Malaysian taxation. Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received in Malaysia from outside MalaysiaThe phrase accruing in or derive from Malaysia means the source of income must be in Malaysia.

The most recent study was undertaken in Malaysia where a readability examination was conducted on the Income Tax Act 1967 ITA 1967 using FRES and F-KGL Saad et al. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. This page is currently under maintenance.

Laws of malaysia reprint published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with malayan law journal sdn bhd and percetakan nasional malaysia bhd 2006 act 53 income tax act 1967 incorporating all amendments up to 1 january 2006 053e fm page 1 thursday april 6 2006 12. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 53Schedule 5. The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income.

Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and reliable as a student text. On 23 November the Inland Revenue Board of Malaysia issued Public Ruling PR No. The Income Tax Act 1967 with Complete Regulations and Rules 5th Edition will provide readers with the latest Income Tax Act with a full compilation of the relevant statutory orders.

Rules and legislative notifications relating to income tax have also been. Alamat Pos Postal Address Kaunter Bayaran Payment Counter SEMENANJUNG MALAYSIA Kompleks Pejabat Kerajaan PENINSULAR MALAYSIA Jalan Duta Lembaga Hasil Dalam Negeri Malaysia Cawangan Pungutan Tingkat 15 Blok 8A. We highlight some of the key amendments issues in the Finance Bill 2016 and the Budget 2017 Appendices as shown below.

The results from. Introduction The Income Tax Act 1967 ITA 1967 is the main source of reference governing the income tax system in Malaysia. Income Tax Act 1967 Kemaskini pada.

Approved ServicesProjectsASP-Section 127 The income of companies undertaking ASP is exempted at statutory levelThe quantum of tax exemption on statutory income varies between 70 and 100 for a period of 5 to 10 years from the date the first income is generatedThe. The inclusion of history notes will also be a valuable feature as readers can track the amendments to the Act in just a single book. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith.

Payment of increase of tax if any should be paid separately using Form CP147 and separate cheque.

Crowe Chat Vol 8 2020 Crowe Malaysia Plt

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Malaysia S Mof Has No Power To Restrict Investment Allowance Claim International Tax Review

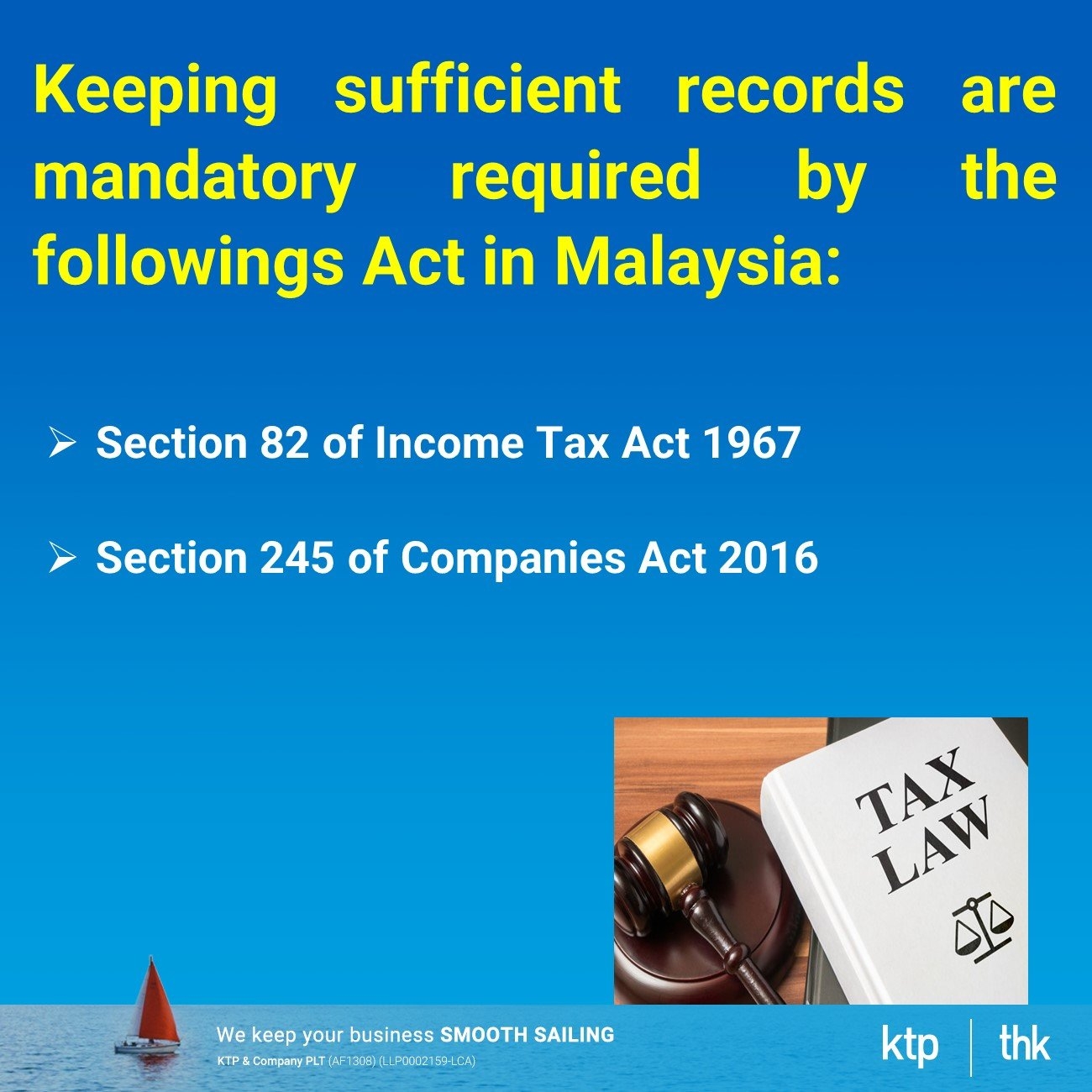

Record Keeping 7 Years Malaysia May 05 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

How Much Does It Cost To Develop A Law Firm Mobile App Development App Development Mobile App Development App Development Cost

Opportunities And Challenges For The Application Of Biodiesel As Automotive Fuel In The 21st Century Hassan Biofuels Bioproducts And Biorefining Wiley Online Library

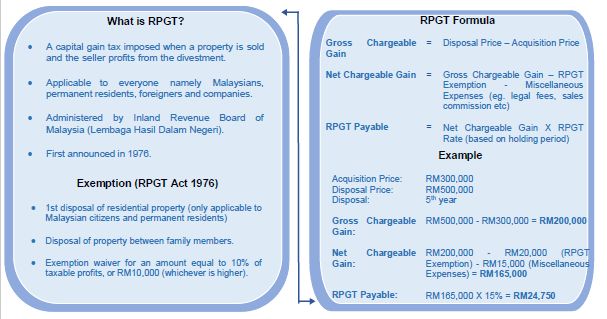

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Crowe Chat Vol 8 2020 Crowe Malaysia Plt

Sustainability Free Full Text The Role Of Education And Income Inequality On Environmental Quality A Panel Data Analysis Of The Ekc Hypothesis On Oecd Countries Html

Buy Income Tax Act Online Lazada Com My

Malaysia S Mof Has No Power To Restrict Investment Allowance Claim International Tax Review